The team composed of Gianfranco Giulioni, Edmondo Di Giuseppe, Piero Toscano, Francesco Miglietta and Massimiliano Pasqui, conducted a study, published in 2019, building a computational model for the analysis of the formation of the international price of wheat, its dynamics and the dynamics of the quantities traded internationally.

This model was calibrated using FAOSTAT data from 1992 to 2013, and is able to generate wheat prices in twelve international markets and to trade quantities of wheat in twenty-four regions of the world.

Very importantly, in this study particular attention was paid to the impact of the 2010 ban on the export of cereals by the Russian Federation on the price of wheat and on the quantities traded internationally.

The model in question is the Commodity Markets Simulator (CMS), i.e. a computational model aimed primarily at the analysis of the formation of spot prices of raw materials, its dynamics and the quantities traded.

The model in question has three types of agents: producers, buyers and markets. All agents are characterized by a geographic location given by latitude and longitude and the interaction between agents occurs in markets.

Considering current information and communication technologies, markets are thought of as virtual places where producers and buyers send information. Therefore, goods are not physically moved to the market from the producer and then to the buyer, but directly from the seller’s location to the buyer’s location. Markets are organized in sessions, each of which is associated with a producer.

The CMS model assumes that each producer has a special relationship with a buyer and that a buyer may or may not have a special relationship with a producer.

Given 12 producers and 24 regions using wheat with monthly frequency, the model produces 12 prices and all the quantities exchanged between them. This is a large amount of data that is much more than the data available in the real world. The main feature of the proposed model is to endogenously generate the dynamics of prices and quantities. It also takes into account the price-quantity interaction in the generation process.

This model allows, in fact, to jointly monitor the dynamics of prices and trade quantities; being able to replicate both the basic characteristics of the trade network and prices. Considering the 2010 export ban of the Russian Federation, allows to evaluate the effects of a real negative event that destroys some parts of the simulated network.

Traditional analytical techniques have difficulty taking into account a large variety of events that in reality often occur. This work is a first step to exploit computational techniques to manage many factors. In particular, we want to build a tool to analyze the dynamics of cereal prices and traded quantities in alternative economic, environmental and climatic conditions.

The careful calibration of the model, together with the inclusion of the crude oil price, allows to replicate the empirical annually weighted world price. From a quantitative point of view, promising results have been obtained, even if a further upgrade of the model is necessary; for example by taking into account climatic factors, or the management of cereal stocks that directly influence the international price.

All these developments will improve the performance of the model. It could therefore be used as a tool to produce reliable forecasts of prices and quantities at both global and regional/national levels. Another important objective of the model is to provide recommendations on prevention policies that most reduce the negative effects of extreme events, on emergency measures that imply less sacrifice for the population and on measures to reduce price volatility.

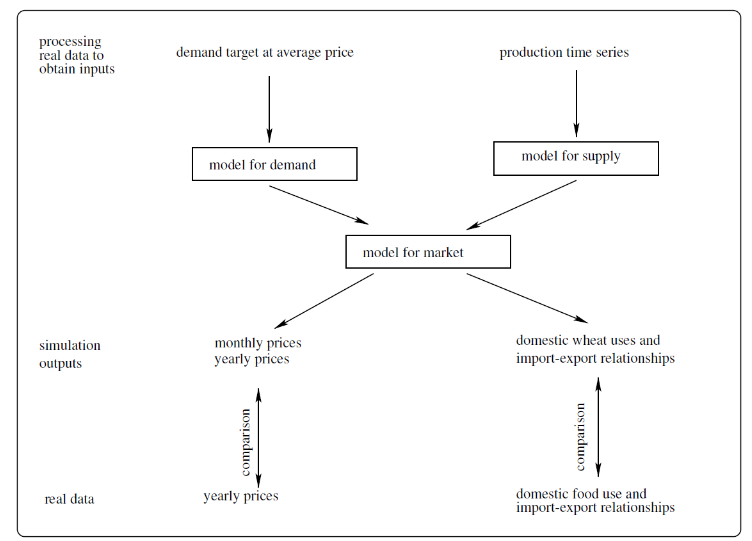

In the figure the visual representation of the CMS-Wheat model (a modelling strategy that involves a gradual introduction of real-world elements. A comparison between the simulation outputs and the corresponding real-world data is a guide to progressively improve the modelling choices and remove the shortcuts taken to keep the initial versions of the model essential and easily understandable).